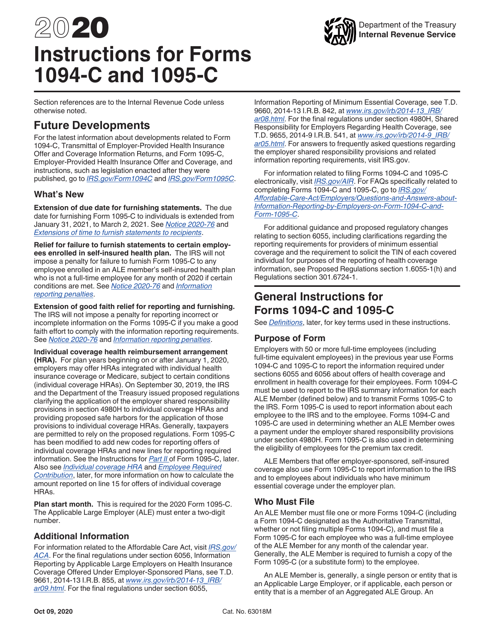

The 1095C form is used by employers with 50 or more fulltime and fulltime equivalent employees (also referred to as applicable large employers or ALEs) to report information required under Section 6056 of the Affordable Care Act This includes their offers of health coverage and the employees' enrollment in health coverageThe IRS has created two sets of codes in order to provide employers with a consistent way to describe their offers of health coverage Each code indicates a different scenario regarding an offer of coverage, or explains why an employer should not be subject to a penalty for a particular employee, for a given monthWhen information on Part II of a 1095C is conflicting with Part III, selfinsured employers are perplexed about their Affordable Care Act reporting

Irs Drafts Of New 16 Forms 1095 C 1094 C Leavitt Group News Publications

How to use form 1095-c

How to use form 1095-c- 1095 C Form Meaning 1095 C Form Turbotax Aca Form 1095 Codes Aca Form 1095 C Codes Aca Form 1095 C Examples Aca Form 1095 C Instructions How Do I Print My 1095 A FormComplete Forms 1094C and 1095C Form 1094C will be submitted to the IRS and Form 1095C will be submitted to the covered employees The IRS will use this information to decide whether the employer should be subject to penalties and to report on the adequacy and extent of the health insurance coverage available

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

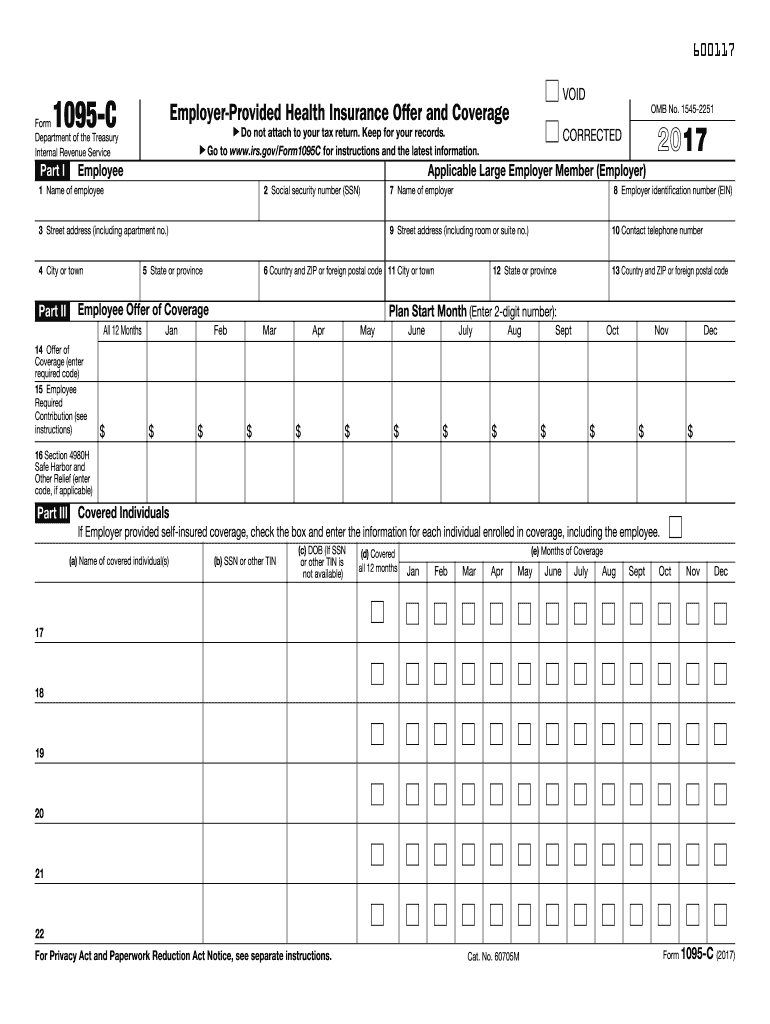

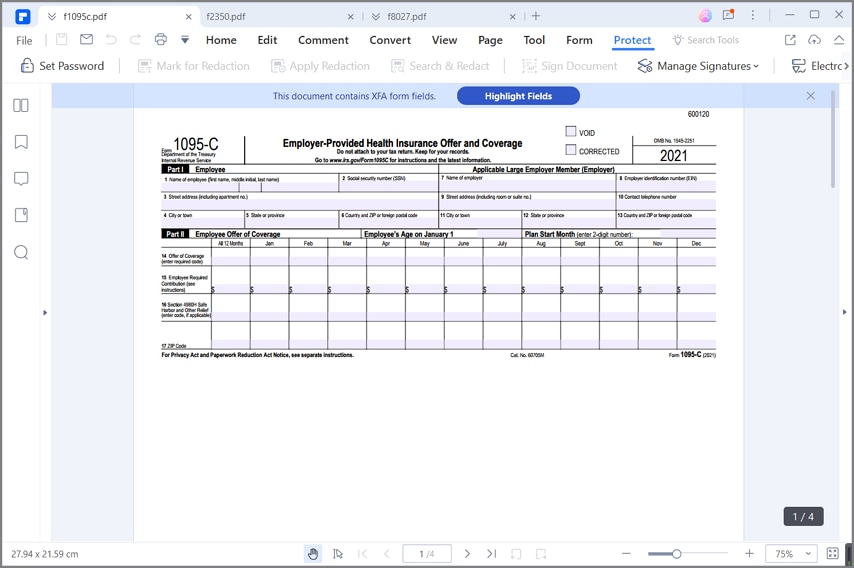

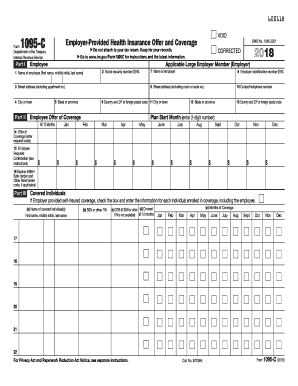

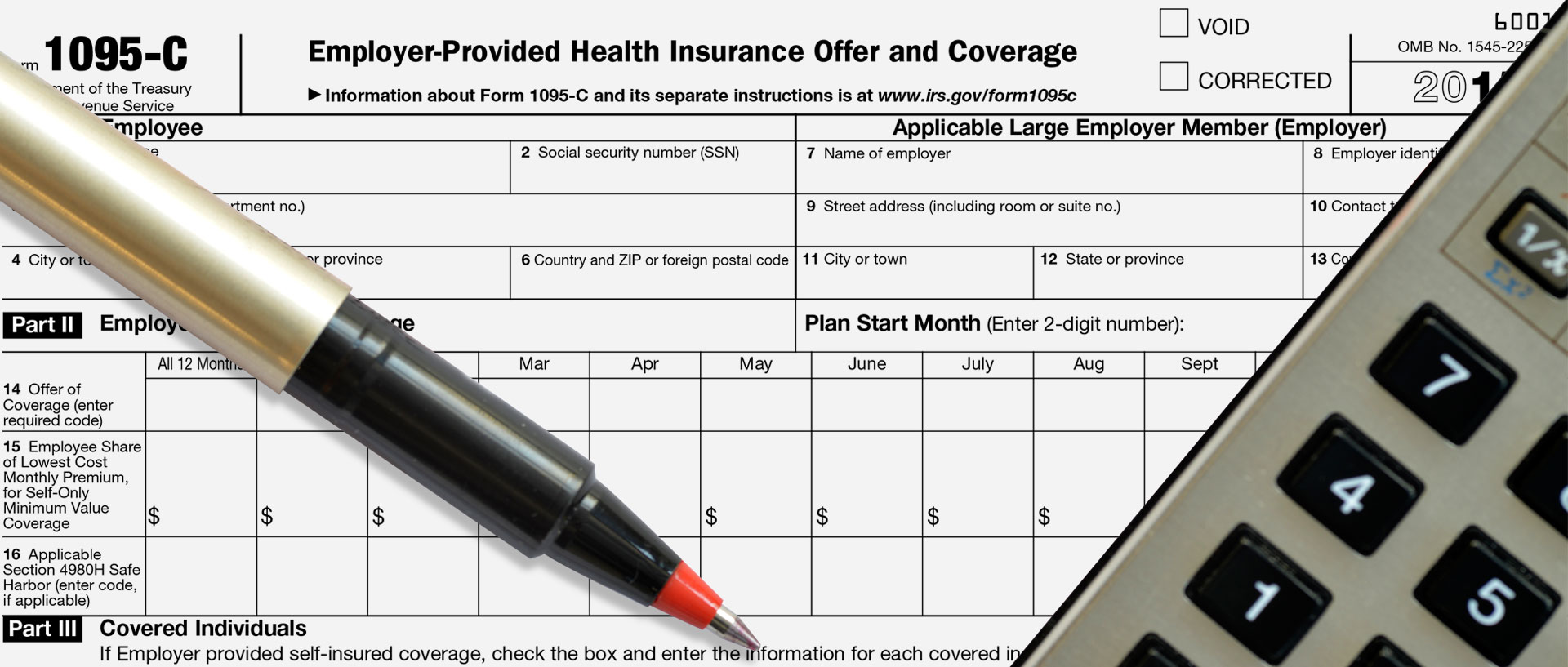

Employees on Form 1095C What is Form 1095C?The Form Below is Form 1095C from the IRS website This guide will explain each piece of the form and help you determine the proper codes for the fields in Part II Shown below in blue, Parts I and III are comprised of lines 113 and 1734, respectively These sections are easily enough, just employee information Part IThe information contained on Form 1095C is informational and allows the preparer to verify that the taxpayer and/or their dependents have minimum essential health care coverage Although the Shared Responsibility Payment (or penalty) has been eliminated by the Tax Cuts and Jobs Act starting with the tax year 19 , employees will continue to receive Form 1095C with

IRS Form 1095 C Information Form 1095C is an annual statement that employers must provide fulltime employees and those covered by its health insurance plan You can get yours Mailed to your home Please be sure your current mailing address is in Self Service It will be mailed to you byA1 The IRS will use the information provided on Form 1095C to administer the Employer Shared Responsibility provisions of the Affordable Care Act ("ACA") Under the ACA, large employers must either offer health insurance coverage, or they could be required to pay a penalty to the IRSCOVERAGE INFORMATION Form 1095B, Line 23(b);

Form 1095C Line 16 Codes are used to report information about the type of coverage an employee is enrolled in and if the employer has met the employer's shared responsibility "Safe Harbor" provisions of Section 4980H The table below explains the code series 2 The Form 1095C is an IRS form created when the Affordable Care Act (ACA) was implemented, and that must be distributed to all employees describing their health insurance cost, opportunities, and enrollment According to the ACA, certain companies must provide an option for health insurance to their employees if the companies are ApplicableOn IRS Forms 1095B and 1095C Q1 What is Form 1095C?

1

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

The ACA Form 1095C, EmployerProvided Health Insurance Offer and Coverage is used by applicable large employers (Employers with 50 employees) to report their employees' health coverage information with What Is Form 1095C EmployerProvided Health Insurance Offer and Coverage?Third, Code 1A, if applicable for all 12 months of the calendar year, allows the employer the choice of giving the employee, in lieu of a copy of the Form 1095C, a statement saying that for all 12 months of the year the employee received an offer of minimum value and affordable health insurance, and, therefore, the employee and his or her spouse and dependents are not eligible for subsidies in an online public health insurance exchange

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Changes Coming For 1095 C Form Tango Health Tango Health

Form 1095 Code Definitions Lines 14, 15, and 16 Line 14 Offer of coverage code 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for selfonly coverage equal to or less than 95% mainlandThe Form 1095C contains important information about the healthcare coverage offered or provided to you by your employer Information from the form may be referenced when filing your tax return and/or to help determine your eligibility for a premium tax creditForm 1095C IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement The Section 6056 reporting requirement relates to the employer shared responsibility/play or pay requirement Information from Form 1095C will also be used in determining whether an individual is eligible for a premium tax credit Line 14 of the 1095C is

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

What Is Form 1095 C Employer Provided Health Insurance Offer And Coverage Turbotax Tax Tips Videos

Form 1095C is sent to those who worked fulltime in 18 for what the IRS calls "an applicable larger employer" That means an employer with 50Determining a company's ALE status is at the center of many employers' struggles to understand if IRS rules for Affordable Care Act reporting apply to themForm 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more

2

:max_bytes(150000):strip_icc()/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

Form 1095C Line by Line Instructions Updated on 1030am by, TaxBandits IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updatedAll fulltime employees at companies with more than 50 fulltime employees will now receive a Form 1095C to report health care coverage offered by their empAs part of the Affordable Care Act, Applicable Large Employers ( ALEs) 1 are required to give each of their fulltime employees a Form 1095C every year, beginning with the 15 tax year They may also have to provide a 1095 C to certain parttime employees, depending on the kind of health coverage

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Free 1095 C Resource Employee Faqs Yarber Creative

Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C is a tax form reporting information about an employee's health coverage offered by an Applicable Large What is the purpose of ACA Form 1095C?Nevertheless, "the Governmental Unit must ensure that among the multiple Forms 1094C filed by or on behalf of the Governmental Unit transmitting Forms 1095C for the Governmental Unit's employees, one of the filed Forms 1094C is designated as the Authoritative Transmittal and reports aggregate employerlevel data for the Governmental Unit, as required in Parts II, III, and IV of Form 1094C

Your 1095 C Obligations Explained

1095 C Reporting Determining A Company S Ale Status Integrity Data

Every year Applicable Large Employers ("ALEs") must file Forms 1094C and 1095C with the IRS and furnish Forms 1095C to employees considered fulltime under the Affordable Care Act ("ACA") Forms 1094C and 1095C are used in combination with the IRS automated Affordable Care Act Compliance Validation (ACV) System to determine whether an ALE owes aForm 1095C when you file your taxes It is not necessary for you to wait for receipt of Form 1095C in order to file your taxes The information on Form 1095C is not required when a tax return is prepared nor is Form 1095C submitted to the IRS with your tax return;Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Streamlined Aca Reporting Methods Newfront Insurance And Financial Services

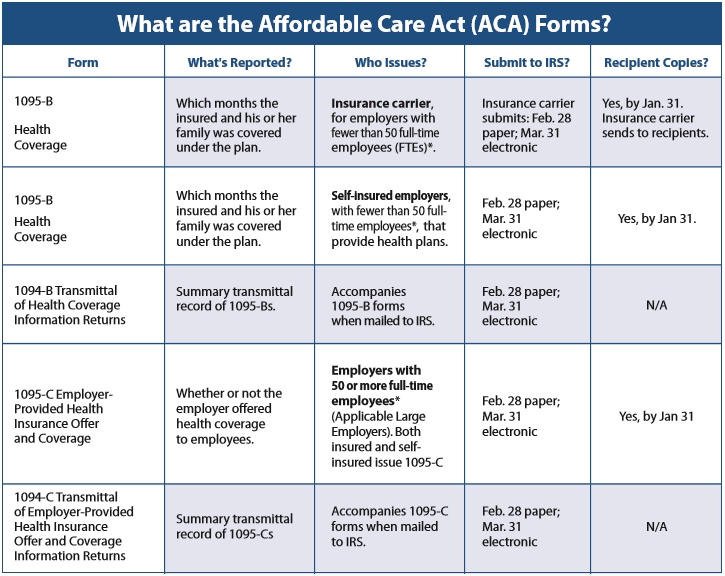

If it is a 1095B or 1095C form that received the TIN Validation Failed, the IRS will specify which individual(s) had an issue with the name and/or TIN If it is a 1094C that received the TIN Validation Failed, the IRS does not specify which name(s)/TIN(s) in the Aggregated ALE Members section caused the error, and there may be multiple errors of this type on a single formForm 1095B, Health Coverage, should come in the mail if you purchased or received insurance outside of an exchange Form 1095C, EmployerProvided Health Insurance Offer and Coverage, is required by companies who meet the qualifications to be considered Applicable Large Employers This includes employers with 50 or more fulltime employees inForm 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C is used by larger companies with 50 or more fulltime or fulltime equivalent employees This form is used by the employee to report the healthcare coverage offered to them by his or her employer 9

Code Series 2 For Form 1095 C Line 16

Form 1095 C The Aca Times

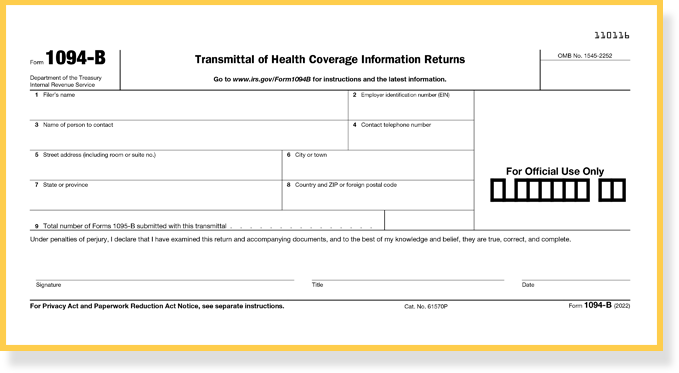

I got this 1095C Form What does it mean and how does it affect my tax liability? IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095C Furthermore, what do the codes on Form 1095 C mean?

Clearing Aca Confusion Which Employees Get Irs Form 1095 C

Understanding Your Form 1095 A Youtube

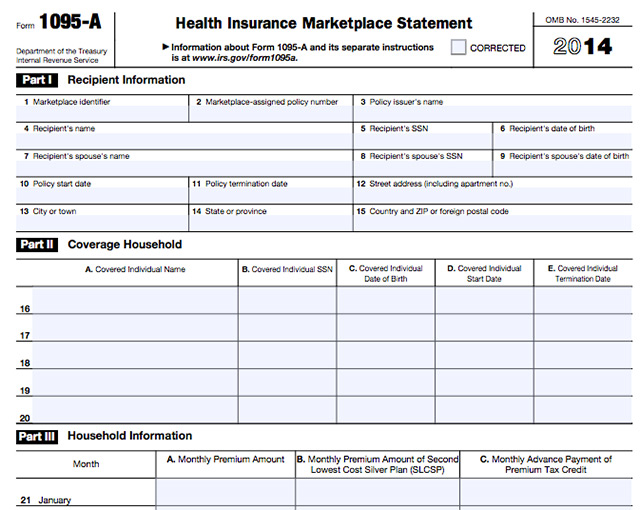

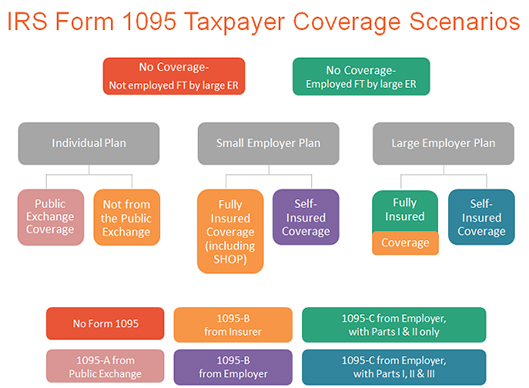

Form 1095A Definition Form 1095A is the Health Insurance Marketplace statement Just about anyone who enrolled in a health insurance plan through the government Marketplace will need to have a copy of the form before they file their taxes It comes from the Marketplace and shows both you and the IRS what you paid outofpocket for yourForm 1095C EmployerProvided Health Insurance Offer and Coverage is an Internal Revenue Service (IRS) tax form reporting information about an employee's health coverage offered by an Applicable Form 1095A, 1095B, 1095C, and Instructions The 1095 forms are filed by the marketplace (1095A), other insurers (1095B), or by your employer (1095C) We have simple instructions for the 1095 forms Keep in mind the 1095 forms are filed by whomever provided you coverage, so individuals won't have to fill them out themselves

Changes In Irs Form 1095 C For Taxbandits Youtube

Guide To Form 1095 H R Block

Deep and Meaningless, Deep & Meaningless, Now Hear Our Meanin, United Nations Security Council Resolution 1095, Captafol, Form 1095, MeaningCloud Form 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was covered This form is sent out by the insurance provider rather than the employerForm 1095C Code Series 1 and 2 The Affordable Care Act (ACA) added two employer reporting requirements to the Internal Revenue Code (Code), which will take effect for 15 reporting Code § 6056 requires applicable large employers (ALEs) to provide an annual statement to each fulltime employee detailing the employer's health coverage offer (or lack of offer)

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Form 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax creditForm 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employeeForm 1095C, Line 17(b) Form 1095 must show social security numbers for every covered person If you do not have the SSN, you may use DOB but Must request SSN at enrollment Must request again no later than December 31 of year enrolled Must request for 3rd time no

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Form 1095 C Basics Best Practices And Hr Compliance Bernieportal

Form 1095C IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement The Section 6056 reporting requirement relates to the employer shared responsibility/play or pay requirement Information from Form 1095C will also be used in determining whether an individual is eligible for a premium tax creditForm 1095C EmployerProvided Health Insurance

Www Whoi Edu Fileserver Do Id Pt 2 P 769

What Is An Irs Form 1095 C Boomtax

Www Khisolutionsinc Com Docs Khi Employee 1095 Faqs Paychex Pdf

Www Toutlesd Org For Staff Affordable Care Act Faqs

1095 C Form Official Irs Version Discount Tax Forms

Tax Form 1095 A Frequently Asked Questions

Irs Reporting Tip 2 Form 1095 C Line 14 Code 1a Versus 1e And When To Use 1i Innovative Benefit Planning

1

Irs Form 1095 C The Best Way To Fill It Out Wondershare Pdfelement

Your 1095 C Obligations Explained

Aca Reporting For Just Got More Complicated Syncstream Solutions

New 1095 C Codes For Tax Year The Aca Times

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/88305472-ACA-reporting-56a0a45f5f9b58eba4b25f4a.jpg)

Health Care Law Reporting Requirements For Employers

Understanding Irs Forms 1095 A 1095 B And 1095 C

Www Fscj Edu Docs Default Source Hr Communications Irs Form 1095 C Faqs Pdf Sfvrsn 2

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Form 1095 A 1095 B 1095 C And Instructions

File Taxes For Obamacare

2

Aca Code Cheatsheet

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 A 1095 B And 1095 C Que Son Y Que Debo Hacer Con Ellos Healthcare Counts

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Questions Answered For Mastering The 1095 C Form Blog Tango Health

Irs 1095 C Form Pdffiller

Know The Basics Form 1095 C Justworks

Updates To Form 1095 C For Filing In 21 Youtube

Sample 1095 C Forms Aca Track Support

1095 C Template Fill Online Printable Fillable Blank Pdffiller

What Your Clients Need To Know About Form 1095 C Accountingweb

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

What Is The Irs 1095 C Form Miami University

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

What Is The Form 1095 C Youtube

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Irs Drafts Of New 16 Forms 1095 C 1094 C Leavitt Group News Publications

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Introduction To Affordable Care Act Health Coverage Returns Air

What Is The Irs 1095 C Form Miami University

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Mn Gov Mmb Stat Segip Doc 1095 C Faq Pdf

Www Toutlesd Org For Staff Affordable Care Act Faqs

Aca Compliance Knowledge Base Integrity Data

Www Irs Gov Pub Irs Prior Ic 14 Pdf

Aca Reporting Tip 22 Aggregated Ale Groups Controlled Groups Usi Insurance Services

Form 1095 A 1095 B 1095 C And Instructions

1095 C Stock Photos Free Royalty Free 1095 C Images Depositphotos

1

Www Fscj Edu Docs Default Source Hr Communications Irs Form 1095 C Faqs Pdf Sfvrsn 2

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Sample 1095 C Forms Aca Track Support

What Are Irs 1095 Forms

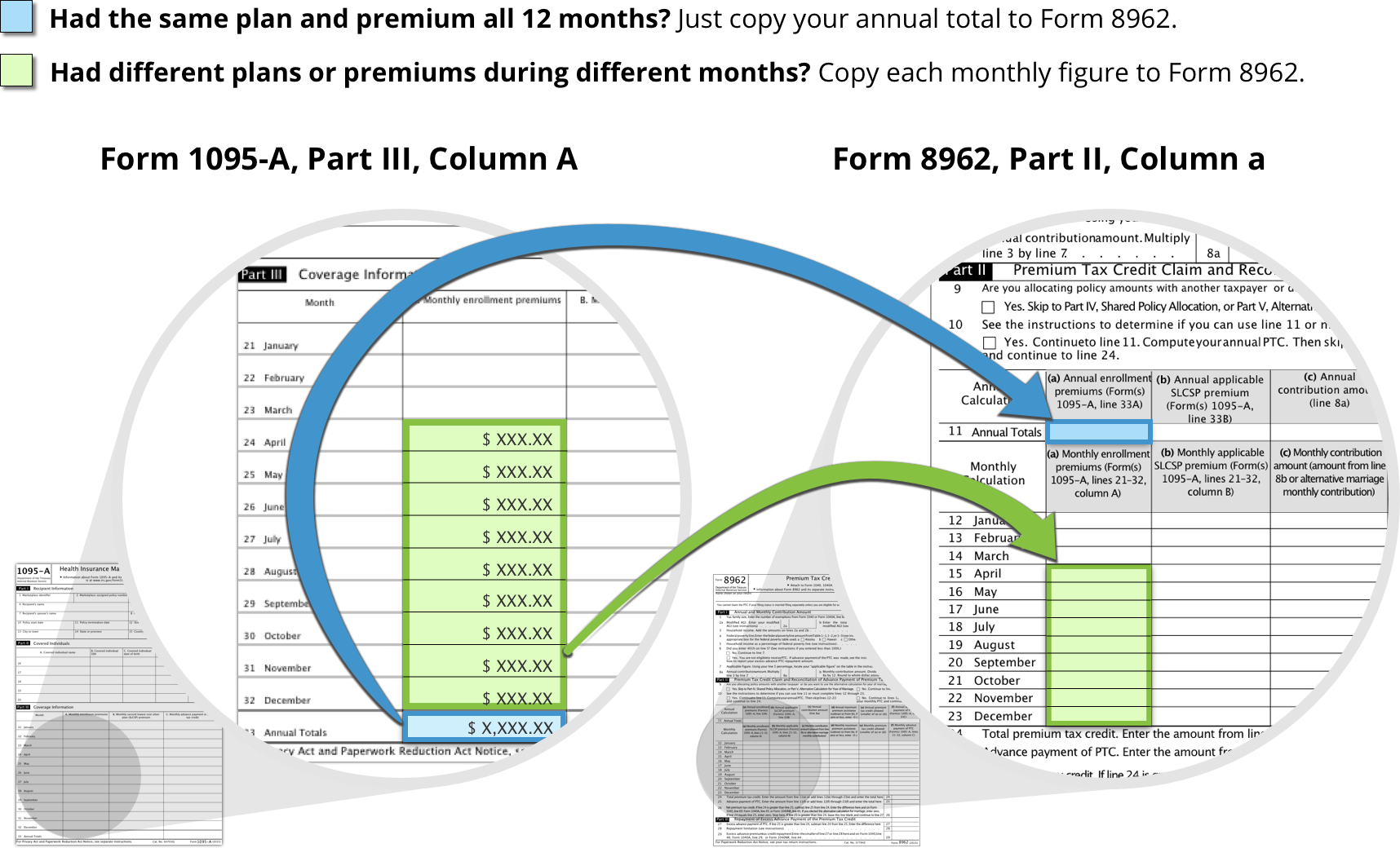

How To Reconcile Your Premium Tax Credit Healthcare Gov

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

1095 A 1095 B And 1095 C Que Son Y Que Debo Hacer Con Ellos Healthcare Counts

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

1095 C Print Mail s

Sample 1095 C Forms Aca Track Support

Ez1095 Software How To Print Form 1095 C And 1094 C

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

What Is A 1095 C Erp Software Blog

1095 C Form Official Irs Version Discount Tax Forms

What The Heck Is Form 1095 C

1095 A 1095 B And 1095 C Que Son Y Que Debo Hacer Con Ellos Healthcare Counts

The Abc S Of Forms 1095a 1095b And 1095c Aca Gps

What Is A 1095 C Erp Software Blog

Form 1095 C Adding Another Level Of Complexity To Employee Education And Communication The Staffing Stream

Form 1095 C Guide For Employees Contact Us

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

1

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Irs Form 1095 C Fauquier County Va

Form 1095 C Basics Best Practices And Hr Compliance Bernieportal

Your 1095 C Obligations Explained

0 件のコメント:

コメントを投稿